March property market update (2025)

- Posted By Nikki Montaser

There was a slight easing of pressure on the rental market with February's vacancy rates increasing or holding steady for all capital cities. There was no increase in total property listings, suggesting advertised rental properties were taking about 3 to 4 days longer to rent and occupy on average, compared to January.

Both rental and sales asking prices remain steady, with Louis Christopher, Managing Director of SQM Research, predicting reduced activity until after election day.

Vacancy rates

SQM Research has reported a national increase in vacancy rates to 1.3% (from 1.0% in January), as well as a slight increase from the same time last year.

See a city-specific breakdown below:

- Sydney: 1.5% vacancy rate, an increase from 10,151 available properties in January to 11,155 in February

- Melbourne: Increased to a 1.8% vacancy rate, with 9,326 vacant properties

- Brisbane: Increased to a 1% vacancy rate, with 3,445 vacant properties, after a staggering dip in January

- Canberra: Increased to a 1.6% vacancy rate, with 961 vacant properties

- Adelaide: Increased slightly to 0.7%, with 830 vacant properties

- Perth: Increased slightly to 0.6%, with 776 vacant properties

- Darwin: Remained stable at 1.1%, with 395 vacant properties

- Hobart: Increased to a 0.6% vacancy rate, with 326 vacant properties

Louis Christopher said the increase in national rental vacancy rates in February was somewhat surprising to us given there was no increase in total rental listings.

“That suggests advertised rental properties were taking about 3 to 4 days longer to rent and occupy on average than January. But I don’t regard that as a material increase. I would not be surprised to see vacancy rates fall again in March which typically records the stronger rental demand.”

Rental values

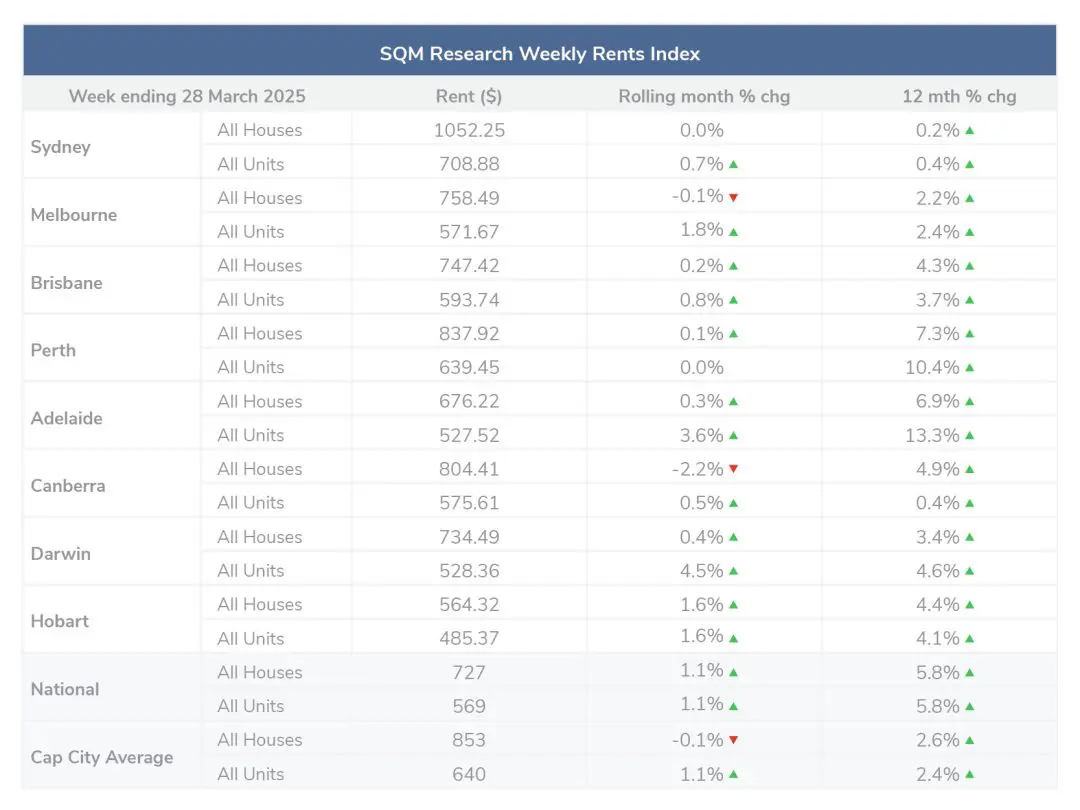

Over the past 30 days…

to 28 March 2025, the national median asking rents increased by 1.1% for both houses and units, a slower increase than reported in February.

Across capital city averages, the median asking rent decreased by -0.1% for houses, driven by decreases in Canberra and Melbourne houses at –2.2% and –0.1% respectively, while Capital city units increased by 1.1%.

The largest variation in unit values was seen in Darwin units, with an increase of 4.5%, followed by Adelaide units at 3.6%.

Compared to this time last year…

regional areas outperformed capital city price growth, as national rental asking prices increased by 5.8% for both houses and units, while the capital city average increased by 2.6% for houses and 2.4% for units.

Average asking prices

The average national rental asking price on 28 March 2025 was $727 for houses and $569 for units.

The capital city average rental asking price on 28 March 2025 was $853 for houses and $640 for units.

Property prices

According to SQM Research’s data reported on 4 March 2025, the Australian property market exhibited the following key trends, with Louis Christopher noting stability, however, he also predicted reduced activity until after election day (3 May 2025).

A continued increase in asking prices

Nationally, asking prices increased in March with a 0.8% increase in house prices, and 0.7% increase in unit prices. Similarly, capital city average asking prices increased by 0.5% for houses and 0.9% for units.

On 1 April 2025, the national asking price for houses was $974,093 and $579,558 for units. The capital city average asking price was $1,439,915 for houses and $728,564 for units.

Key Takeaways

Perth led the market with the highest combined asking price growth (2.1%), driven by strong unit price gains (5.4%).

Brisbane and Hobart also recorded strong growth, at 1.5% and 1.2%, respectively.

Canberra was the only capital city to experience a decline (-1.9%), primarily due to falling house prices.

Sydney and Melbourne recorded steady gains (0.8%), showing continued market confidence.

Louis Christopher said overall, listing activity was stable for the month of March.

“However, there was another uptick in older listings, particularly for the city of Perth which recorded a 15% jump. This is an indicator that the Perth housing market might be slowing in activity,” he added.

“Going forward, with the Federal election now called, its quite likely we will see reduced activity levels in the housing market until after election day. The RBA not cutting interest rates may also cool the heels of would-be home buyers.”

Cash rate and predictions

On 2 April, the RBA held the cash rate target steady at 4.10% stating recent information suggests that underlying inflation continues to ease in line with the most recent forecasts published in the February Statement on Monetary Policy.

“Nevertheless, the Board needs to be confident that this progress will continue so that inflation returns to the midpoint of the target band on a sustainable basis. It is therefore cautious about the outlook.”

Disclaimer: The information enclosed has been sourced from SQM Research and Reserve Bank of Australia, and is provided for general information only. It should not be taken as constituting professional advice.

PropertyMe is not a financial adviser. You should consider seeking independent legal, financial, taxation, or other advice to check how the information relates to your unique circumstances.

We link to external sites for your convenience. We are selective about which external sites we link to, but we do not endorse external sites. When following links to other websites, we encourage you to examine the copyright, privacy, and disclaimer notices on those websites.

Article posted by Property Me.