February property market update (2025)

- Posted By Nikki Montaser

The housing crisis is far from over, with vacancy rates dropping to 1% in January, and a marginal increase in rental values occurring across most cities. Sales asking prices also experienced movement, with a slight increase overall, alongside a significant increase in listings.

February brought good news for mortgage holders as for the first time in four years, the Reserve Bank decreased the cash rate target, however, Louis Christopher commented, “These numbers do not yet reflect any shift in sentiment from either buyers or sellers following the February interest rate cut.”

Vacancy rates

SQM Research has reported that the sharp decrease in rental vacancies in early 2025 has continued into February, a strong sign Australia’s rental crisis refuses to subside.

National vacancy rates decreased in January to 1%, a significant drop from the previous month’s 1.6% in January, and the previous year’s 1.1% in February 2024.

See a city-specific breakdown below:

- Sydney: After a brief period of relief in late 2024 Sydney’s rental vacancy rate decreased to 1.4%

- Melbourne: A sharp decline was reported in Melbourne, dropping to 1.5%

- Brisbane: SQM Research reported that at 0.8% ‘Brisbane experienced the second lowest vacancy rate ever recorded for Brisbane since SQM’s records begun in 2005. The record low of 0.7% was registered in May 2022’

- Canberra: Decreased to 1.3%

- Darwin: The vacancy rate decreased to 1.1%

- Hobart: Recorded its equal lowest rental vacancy rate ever recorded for itself and among the capitals at just 0.3%

- Perth: Remained stable at 0.4%

- Adelaide: Remained stable at 0.5%

Rental values

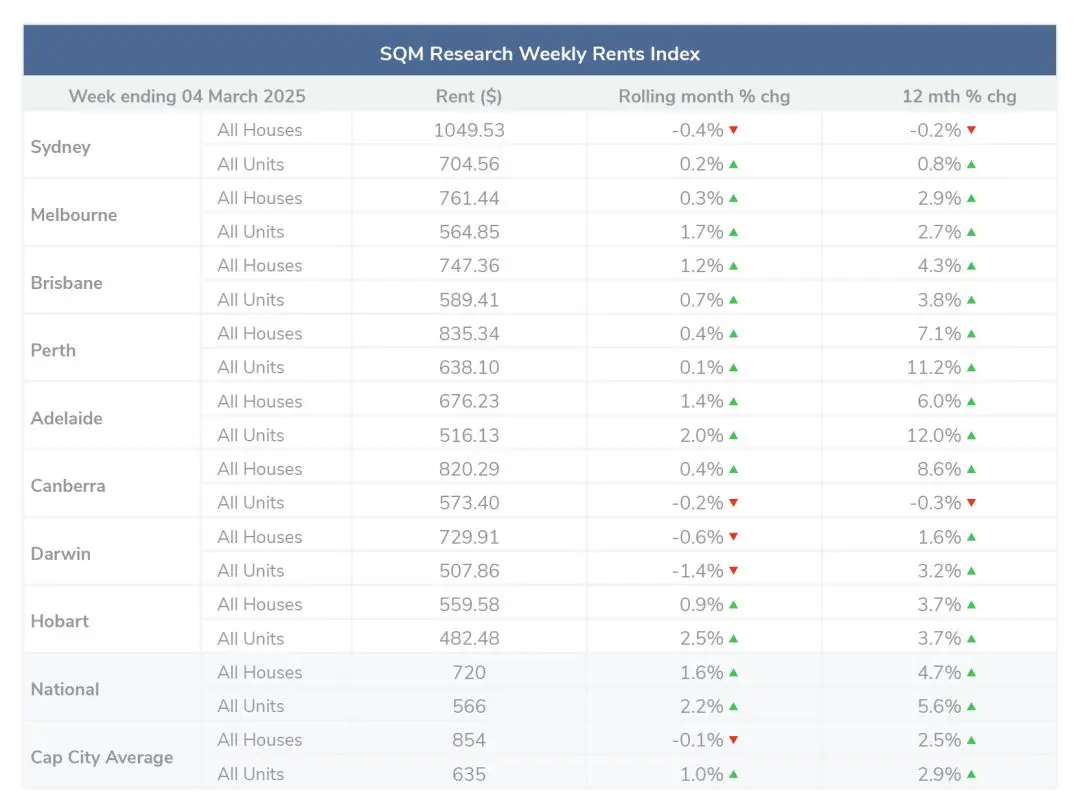

Over the past 30 days to 4 March 2025, the national median asking rents for houses increased by 1.6% and increased for units by 2.2%. Across capital city averages, the median asking rent decreased by -0.1% for houses and increased by 1.% for units.

The largest variation in values was seen in Hobart units, with an increase of 2.5%

Compared to this time last year, most capital cities reported an increase in values, with just Canberra units and Sydney houses experiencing marginal declines at -0.3% and -0.2% respectively.

The average national rental asking price on 4 March 2025 was $720 for houses and $566 for units. Compared to last year, the national rental asking prices increased by 4.7% for houses and 5.6% for units.

The capital city average rental asking price on 4 February 2025 was $854 for houses and $635 for units. Compared to last year capital city asking prices increased by 2.5% for houses and 2.9% for units.

Property prices

According to SQM Research’s data reported on 4 March 2025, the Australian property market exhibited the following key trends:

A marginal increase in asking prices

February asking prices were on the rebound after a slight dip in January. Nationally, asking prices increased by 0.3% for houses and 1.1% for units. Capital cities performed slightly stronger with average increases of 1% for houses and 1.6% for units.

Particularly significant increases were seen in the asking price for Brisbane units at 3.22%, Perth units at 2.1%, as well as Adelaide which performed strongly across the board with a 2.2% increase for houses and a 1.6% increase for units.

On the other end of the spectrum, Hobart and Canberra recorded decreases in unit prices by -1.5% and -0.2% respectively.

At 4 February 2025, the national asking price for houses was $965,938 and 575,313 for units. The capital city average asking price for houses was $1,432,456 for houses and $722,384 for units.

Additional insights include:

An increase in total property listings nationally by a staggering 43.6% over the past 30 days, representing a 2% rise from February 2024. This was led by increases in Melbourne, Sydney and Canberra at 63.1%, 60.1% and 60% increases respectively.

An increase in older listings nationally, as properties listed for over 180 days increased by 0.6% from the previous month, a 10.7% increase from this time last year.

Louis Christopher, Managing Director of SQM Research said, “Overall, it remains a strong start to 2025 when it comes to residential property listings activity. Total listings are up by 4%, year on year. This in part driven by a rise in new listings activity, however I note that there has been a substantial rise in old listings for Sydney and Melbourne, indicating an overhang of sorts for those two cities. These number do not yet reflect any shift in sentiment from either buyers or sellers following the February interest rate cut. And I note asking prices still show some softness in our two largest capital cities. Going forward, it is likely we will record another rise in listings for the current month of March. Then the listings market is likely to go into a bit of a hiatus for the April public holiday period and will stay that way until the Federal Election has concluded.”

Cash rate

On 19 February, the RBA decreased the cash rate target to 4.10% — the first decrease in four years, stating, “The Board’s assessment is that monetary policy has been restrictive and will remain so after this reduction in the cash rate. Some of the upside risks to inflation appear to have eased and there are signs that disinflation might be occurring a little more quickly than earlier expected.”

Disclaimer: The information enclosed has been sourced from SQM Research and Reserve Bank of Australia, and is provided for general information only. It should not be taken as constituting professional advice.

PropertyMe is not a financial adviser. You should consider seeking independent legal, financial, taxation, or other advice to check how the information relates to your unique circumstances.

We link to external sites for your convenience. We are selective about which external sites we link to, but we do not endorse external sites. When following links to other websites, we encourage you to examine the copyright, privacy, and disclaimer notices on those websites.

Article posted by Property Me.