January property market update (2025)

- Posted By Nikki Montaser

Vacancy rates increased to 1.6% in December with a marginal decrease to asking rents. Sales asking prices also experienced marginal movement, with a decrease overall, whilst boasting an influx of new listings in the new year.

Vacancy rates

In December 2024, SQM Research reported a slight increase in Australia’s national residential vacancy rate to 1.6%, with rental vacancies increasing to 47,336 properties in November from 41,894 in October. City-specific trends mirrored this national increase to varying degrees.

See a city-specific breakdown below:

- Sydney: Climbed to 2.1%, vacancy rates were indicative of an influx in the new year

- Melbourne: Also increased, reaching 2.2%, representing 11,775 vacant dwellings

- Brisbane: The capital of the Sunshine State saw a conservative rise to 1.2%

- Canberra: Maintained one of the highest vacancy rates at 2.1%

- Perth: In 2024 the capital of the West Coast remained competitive with a low vacancy rate of 0.7%

- Darwin, Adelaide and Hobart: All saw seasonal increases with rates rising to 1.7%, 0.8% and 0.6%

Rental values

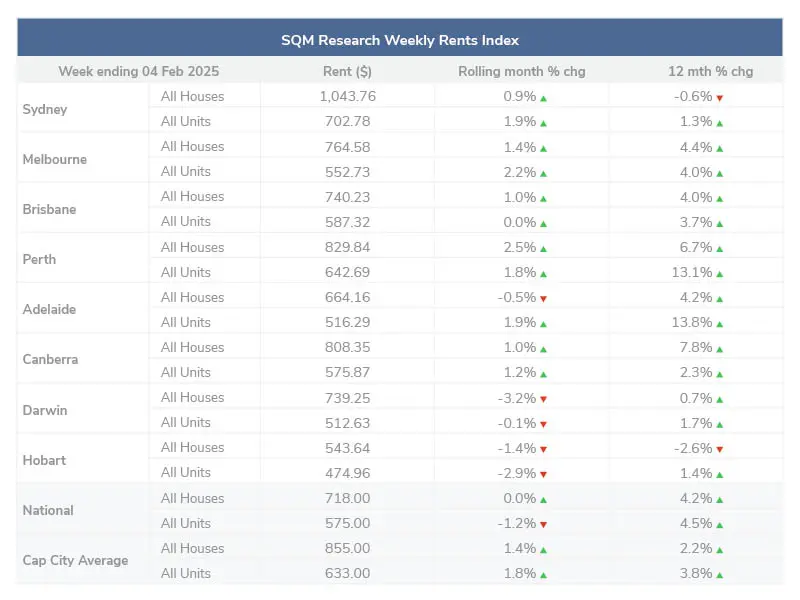

Over the past 30 days to 4 February 2025, the national median asking rents for houses remained the same and decreased by 1.2% for units, changing from last month’s increases. Across capital cities averages, the median asking rent increased marginally than the previous few months at 1.4% for houses and 1.8% for units.

Sydney, Melbourne, Brisbane, Perth and Canberra all saw increases in rental values over the past month. Adelaide experienced varied results, whilst Darwin and Hobart saw decreases across the board.

The largest variation in values over the last year was seen in Adelaide and Perth. Adelaide saw a 13.8% rolling increase in unit rental values. Perth followed suit with an increase of 13.1% for units, from this time last year.

The average national rental asking price on 4 February 2025 was $718 for houses and $557 for units. Compared to last year, the national rental asking prices increased by 2.2% for houses and 3.8% for units.

The capital city’s average rental asking price on 4 February 2025 was $855 for houses and $633 for units. Compared to last year capital city asking prices increased by 2.2% for houses and 3.8% for units.

Property prices

According to SQM Research’s data collected on 4 February 2025, the Australian property market exhibited the following key trends:

Decreases in property asking prices

Nationally asking prices across the month of January decreased by 0.8% for houses and remained the same for units. Similarly, capital city asking prices increased by 0.8% for houses and decreased by 0.4% for units.

This trend reflects varying market dynamics across different cities, with some areas experiencing more significant price decreases than others. Perth was the only capital city to see increases in both house and unit asking prices. Sydney, Melbourne, Brisbane and Canberra experienced decreases in both houses and units. Darwin and Hobard saw mixed results across houses and units.

At 4 February 2025 the national asking price for houses was $963,473 and for units was $568.962. The capital city average asking price for houses was $1,418.170 for houses and $710.683 for units.

Additional insights include:

An increase in total property listings nationally by 10.3% in January 2024, reaching 243,642 properties was experienced. Canberra led this increase with a 30.7% rise, while Darwin and Adelaide saw marginal decreases.

A strong start to 2024 with an increase in new property listings by 18.1% nationally, totaling 53,019 properties was experienced. Canberra recorded the largest monthly increase at 41.8%, Darwin, however, experienced a dramatic decline of 35.5% in new listings.

An increase in older listings nationally, as properties listed for over 180 days increased by 7.2% from the previous month, totaling 71,835 properties was experienced. Perth saw the most significant monthly increase at 21.3%, while Darwin saw a marginal monthly increase at 1.6%.

A decrease in distressed listings was experienced. The number of residential properties sold under distressed conditions dropped by 8.9% to 4,782. Western Australia saw a dramatic decrease of 22.3%. Contrastingly, Tasmania saw a steep increase of 26.1%.

Louis Christopher, Managing Director of SQM Research said, “2025 appears to have started strongly on the residential property listings front across the country with a 10% rise in total property listings, driven by a sharp rise in new listings. At this stage, it is hard to know whether this has been driven by a rise in vendor confidence or a fear by vendors seeking to exit the market now. Afterall, let’s recall, 2024 did end on a rather weak note and the expectations of an imminent cut in interest rates only occurred from last week’s inflation numbers. Going forward, the RBA’s meeting and interest rate decision on the 18th of February will naturally be the focus for most participants. If an interest rate cut does occur, we believe this will lift confidence in buyer demand with housing prices expected to rise between 6% to 10% for the year.”

Cash rate and predictions

The RBA did not meet in January, therefore the cash rate target remained at 4.35%. The RBA will meet again in February.

Disclaimer: The information enclosed has been sourced from SQM Research and Reserve Bank of Australia, and is provided for general information only. It should not be taken as constituting professional advice.

PropertyMe is not a financial adviser. You should consider seeking independent legal, financial, taxation, or other advice to check how the information relates to your unique circumstances.

We link to external sites for your convenience. We are selective about which external sites we link to, but we do not endorse external sites. When following links to other websites, we encourage you to examine the copyright, privacy, and disclaimer notices on those websites.

Article posted by Property Me.