August property market update (2024)

- Posted By Nikki Montaser

In August 2024, national vacancy rates held steady at 1.3% and rental prices saw a notable decline in most areas.

Vacancy rates

In August vacancy rates held steady nationally at 1.3%, with a slight decrease in the number of rental vacancies in Australia from 40,486 in June to 38,864 vacancies in July. Sydney maintained a consistent vacancy rate of 1.7% and Melbourne increased by 0.2% to 1.5%.

Slight increases were seen across Canberra at 2.2%, Perth at 0.8% and Adelaide at 0.7%.

A slight decrease was seen in Darwin, dropping from 0.9% in June to 0.7% in July and a noteable decrease was seen in Hobart, with a decrease from 1.5% in June to 1.2% in July.

Louis Christopher, Managing Director of SQM Research said, “…it should also be stated that the rental crisis is still not yet over as we have recorded an ongoing low national rental vacancy rate of just 1.3%.”

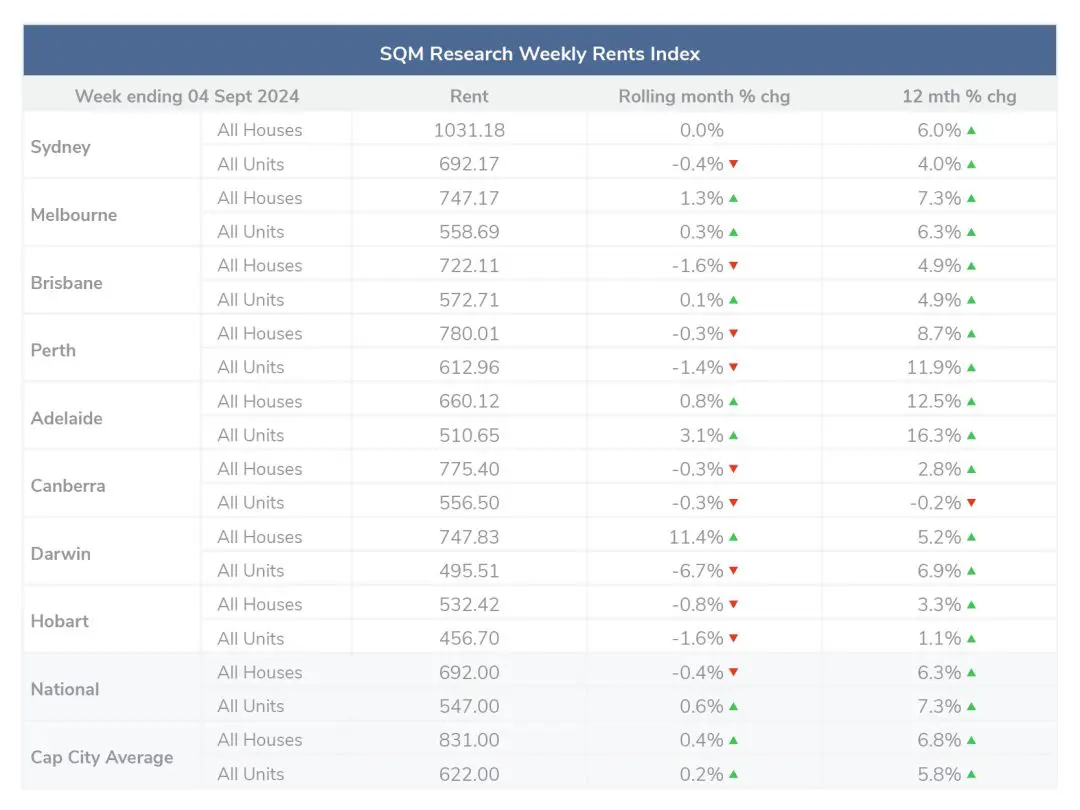

Rental values

Over the past 30 days to 12 August 2024, decreases in rental values were seen nationwide with a decrease of -0.4 for houses and -0.3% for units, while capital city averages experienced the largest monthly rental falls since the outbreak of COVID-19 with a -0.8% decrease in houses and -0.2% decrease in units.

Despite having extremely tight vacancy rates of 0.8%, Perth experienced a decrease in asking prices of -0.6%, alongside capital cities Brisbane at -0.5%, Sydney at -1%, Hobart at -1.6% and Melbourne at -0.6%.

Capital cities experiencing increases in asking prices included Adelaide at 1.1% and Darwin at 6.4%.

The average national rental asking price at 12 August 2024 was $692 for houses and $544 for units. Compared to last year, the national rental asking prices increased by 7.8% for houses and 7.5% for units.

Over the past 30 days to 12 August 2024, across capital cities, there was a -0.8% decrease in house prices to $825 per week and -0.2% decrease in unit prices to $623 per week. Compared to last year capital city asking prices increased by 6.3% for houses and 6% for units.

Louis Christopher, Managing Director of SQM Research said, “For the past 30 days, SQM Research has recorded the largest decline in capital city rents since the days of 2020 when Covid first hit the country.

“The falls were broad based, with the larger falls recorded in our larger capital cities and regional coastal locations. It should be noted of course that rents are still very high and this retracement is minor compared to the massive rise in rents recorded around the country since 2021.

“But still, this will be somewhat welcoming to tenants and as a research house, we do believe the market rental rises of 10 to 20% per annum are now over.”

Property prices

Across the past 30 days to 3 September 2024 national residential property listings increased by 7.9% in August, with an 11.8% surge in new listings entering the market. Year on year, total national property listings are up by 11.1%. Notably, Sydney’s new listings were the highest level for August, ever recorded.

Asking prices increased slightly nationally with houses up by 0.3% and units up by 0.4%. Across capital cities, asking prices increased by 0.7% for houses and decreased marginally by -0.2% for units.

Across the capital cities:

- Sydney house prices remained steady, units decreased by -0.3%

- Melbourne house prices increased by 0.1%, units decreased by -0.3%

- Brisbane house prices increased by 2.3%, units increased by 0.8%

- Perth house prices increased by 2.8%, units increased by 0.5%

- Adelaide house prices increased by 2.1%, units increased by 1.4%

- Canberra house prices decreased by -2.6%, units increased by 0.5%

- Hobart house prices decreased by 0.8%, units decreased by -2.8%

Louis Christopher, Managing Director of SQM Research said, “The housing markets in Sydney and Melbourne continue to slow, driven by some caution from home buyers and uncertainty by home sellers who have become a little more negotiable in recent weeks.

“Going forward, the Spring selling season will provide a significant level of choice for buyers, particularly in Sydney and Melbourne with listings at their highest levels in some years.”

At 3 September 2024

The national median asking price for houses was $935,263, an increase of 0.3% over the past 30 days and an 8% increase over the past year. The national median asking price for units was $556,394, a 0.4% increase over the past 30 days and an 8.3% increase over the past year.

The capital city average asking price for houses was $1,390,085 and a unit was $690,777.

Capital city average asking prices for houses increased by 0.7% over the past 30 days and 7.7% over the past year. Capital city unit prices decreased by -0.2% over the past 30 days however increased by 9.1% over the past year.

Cash rate and predictions

August saw the RBA hold the cash rate target at 4.35% stating, “Inflation remains above target and is proving persistent. Inflation has fallen substantially since its peak in 2022, as higher interest rates have been working to bring aggregate demand and supply closer towards balance. However,But inflation is still some way above the midpoint of the 2–3 per cent target range.

The economic outlook is uncertain and recent data have demonstrated that the process of returning inflation to target has been slow and bumpy.”

Disclaimer: The information enclosed has been sourced from SQM Research and Reserve Bank of Australia, and is provided for general information only. It should not be taken as constituting professional advice.

PropertyMe is not a financial adviser. You should consider seeking independent legal, financial, taxation, or other advice to check how the information relates to your unique circumstances.

We link to external sites for your convenience. We are selective about which external sites we link to, but we do not endorse external sites. When following links to other websites, we encourage you to examine the copyright, privacy, and disclaimer notices on those websites.

Article posted by Property Me.