April property market update (2024)

- Posted By Nikki Montaser

Vacancy rates

Vacancy rates held steady in March at 1%, with a slight increase in the number of available properties with 31,356 available residential properties.

Perth and Adelaide recorded the lowest vacancy rates at 0.5% with regional areas of South West Perth, South Western Sydney, Liverpool and Canterbury-Bankstown all sitting below 1% vacancy.

Louis Christopher, Managing Director of SQM Research said, “National rental vacancy rates for the month of March were actually up a little on the absolute numbers; but the overall vacancy rate just managed to stay steady. The immediate outlook is vacancy rates are set to rise somewhat into the cooler months. This is the normal seasonality we get at this time of year so one should be a little careful about reading into these rises. Nevertheless, it might provide some minor relief to tenants who still have excessive difficulties in finding longer term rental accommodation around the country.

The full year outlook remains the same in that we expect overall tight vacancy rates to be with us for 2024, driven by a fall in dwelling completions relative to growing demand.”

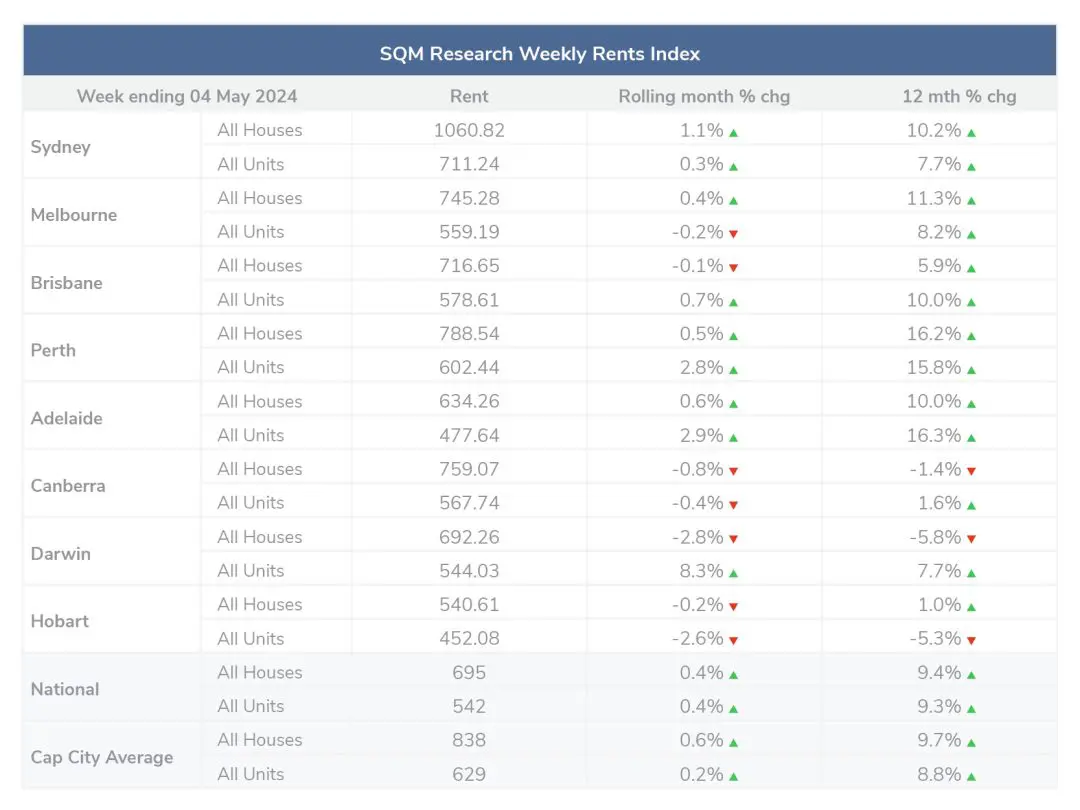

Rental values

Over the past 30 days to 4 May 2024, national weekly asking prices rose by 0.4% for both houses and units. The average national asking price is $695 for houses and $542 for units. Compared to last year, the national asking prices increased by 9.4% for houses and 9.3% for units.

Over the past 30 days to 4 May 2024, across capital cities there was an average 0.6% increase in house prices to $838 per week and 0.2% increase in unit prices to $629 per week to $834 per week. Compared to last year capital city asking prices increased by 0.6% for houses and 0.2% for units.

Property prices

Attributed to the Easter break and school holiday period, April experienced a 6.4% decrease in national residential property listings, seen across all major cities.

Of this, across the past 30 days the was:

- -15.7% decrease in new property listings, experienced largely in Sydney, Canberra and Hobart

- -1.1% decrease in older listings (greater than 180 days)

- -1.8% decrease in distressed listings

Compared to this time last year, there are 5.6% more listing available.

The following yearly changes were recorded:

- 10.6% increase in new listings

- 8.8% increase in old listings

- -9.3% decrease in distressed listings

“Listings were down in April due in large part to the school holiday/Easter period however we note the continued year on year rise at the national level. Total listings have been returning back to their normal long term average levels after recent years of being in acute shortage.

I also note that asking prices, while they did rise nationally by 0.5%, fell in our two largest capital cities signalling some vendor caution and eagerness to meet the market. We will be watching this indicator more closely over the weeks and months ahead.

As the realisation sets in for all market participants that an interest rate cut is not imminently coming, we expect market caution to build over the winter months and so do not at this time rule out some housing price falls in our largest capital cities for the 2nd half of 2024.”

At 7 May 2024

The national medium asking price for houses is $918,949, an increase of 0.2% over the past 30 days and an 11% increase over the past year. The national median asking price for units is $529,917, a 0.2% increase over the past 30 days and a 5.1% increase over the past year.

The capital city average asking price for houses is $1,375,815 and a unit is $673,854.

Capital city average asking prices for houses increased by 1% over the past 30 days and 10.7% over the past year. Capital city unit prices increased by 0.7% over the past 30 days and 5.4% over the past year.

Cash rate and predictions

The RBA did not meet in April, holding the cash rate target at 4.35% for the sixth consecutive month.

Disclaimer: The information enclosed has been sourced from SQM Research and Reserve Bank of Australia, and is provided for general information only. It should not be taken as constituting professional advice.

PropertyMe is not a financial adviser. You should consider seeking independent legal, financial, taxation, or other advice to check how the information relates to your unique circumstances.

We link to external sites for your convenience. We are selective about which external sites we link to, but we do not endorse external sites. When following links to other websites, we encourage you to examine the copyright, privacy, and disclaimer notices on those websites.

Article posted by Property Me.