December property market update (2023)

- Posted By Nikki Montaser

The national residential rental vacancy rate experienced a seasonal stabilisation in November with a marginal increase to 1.1%, while asking prices continue to increase for both houses and units nationwide.

Vacancy rates

The national residential rental vacancy rate stabilised in November with an additional 3,164 vacant properties nationwide, resulting in a marginal increase to 1.1%, from October’s 1%.

CBD areas experienced the highest increase in vacancies with Sydney CBD increasing to 4.6%, Melbourne CBD increasing to 5.1% and Brisbane CBD increasing to 2.2%.

SQM Research has attributed the rise to seasonal trends, noting international student departures as contributing to the CBD area stabilisation.

Harry Bawa, Head of Property and Business Analytics of SQM Research said, “At this time of year, we usually see more properties become available for rent, spearheaded by inner city apartments. This year was no exception as international student departures put more rentals on the market in the CBD areas.”

Rental values

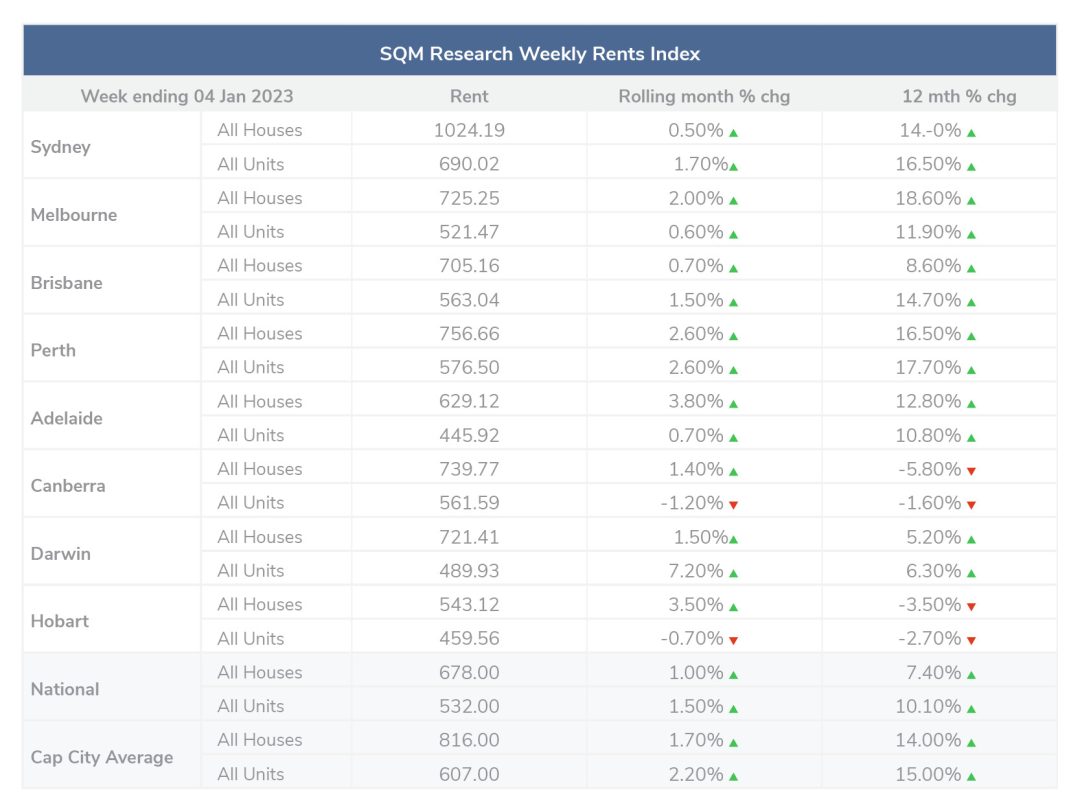

Over the past 30 days to 4 January 2023, national weekly asking prices rose by 1% for houses and 1.5% for units. The capital city average weekly rent increased by 1.7% for houses and 2.2% for units.

Compared to last year, the national asking prices increased by 7.4% for houses and 10.1% for units. The capital city average asking price increased by 14% for houses and 15% for units.

On 4 January 2024, the national median weekly asking rent was $678 per week for a house and $532 per week for a unit. The median capital city asking rent for a house was $8016 per week for a house and $607 per week for a unit.

Harry Bawa, Head of Property and Business Analytics of SQM Research said, “Market conditions for renters remain tight and competitive, and we see no signs of that changing without more housing supply.”

Property prices

National total property listings decreased by 5.2% in December, with 12,868 fewer listings than recorded in November 2023. A decrease in listings was experienced across all major cities, with notable declines experienced in Sydney with a 15.2% reduction in total listings and 47.6% reduction in new listings, and Canberra with an 11.4% reduction in total listings and 45% reduction in new listings.

Across the past 30 days up to 2 January 2024, national asking prices for houses decreased marginally by -0.2% to $882,966 and units increased by 0.2% to $524,640. The capital city average increased by 1.9% for houses to $1,353,925 and 0.1% for units to $660,053.

Compared to this time last year, national asking prices for houses have increased by 6.1% and units have increased by 5.7%. The capital city average increased by 8.7% for houses and 6.2% for units.

Harry Bawa, Head of Property and Business Analytics of SQM Research said, “It’s no surprise that listings and activity in the residential property market fell in December, with the commencement of the holiday season. It is interesting to note that overall national listings were slightly higher in Dec 23, than they were in Dec 22, with Adelaide was the only exception – seemingly because of its relative affordability, and extremely tight rental market.”

Cash rate

December saw the RBA hold the cash rate target at 4.35%.

Michele Bullock, Governor: Monetary Policy Decision commented, “Higher interest rates are working to establish a more sustainable balance between aggregate supply and demand in the economy. The impact of the more recent rate rises, including last month’s, will continue to flow through the economy. High inflation is weighing on people’s real incomes and household consumption growth is weak, as is dwelling investment. Holding the cash rate steady at this meeting will allow time to assess the impact of the increases in interest rates on demand, inflation and the labour market.”

Disclaimer: The information enclosed has been sourced from SQM Research and Reserve Bank of Australia, and is provided for general information only. It should not be taken as constituting professional advice.

PropertyMe is not a financial adviser. You should consider seeking independent legal, financial, taxation, or other advice to check how the information relates to your unique circumstances.

We link to external sites for your convenience. We are selective about which external sites we link to, but we do not endorse external sites. When following links to other websites, we encourage you to examine the copyright, privacy, and disclaimer notices on those websites.

Article posted by Property Me.